You’re living the expat dream in sunny Southeast Asia. But you still need car insurance.

As an expat in Thailand, you have options when it comes to car insurance.

-

- But where do you even begin?

-

- Which coverage and add-ons make the most sense?

-

- And how much should you expect to pay?

Walk you through it

Don’t worry, we’ve got your back. We’ll walk you through everything you need to know about buying expat car insurance in Thailand.

We’ll look at the minimum coverage required, compare comprehensive vs third party, and break down the extras you may want to consider. We’ll even give you tips on how to get the best rates…

Understanding Expat Car Insurance in Thailand

Getting car insurance as an expat in Thailand can be confusing. Here’s what you need to know. There are three main options for expats:

Go local:

Buying from a local Thai insurer.

Possibly the cheapest.

International:

Getting international car insurance from a global insurer.

Gives coverage abroad but can be pricey.

Local expat agent:

Buying a policy meant for expats living in Thailand.

A good middle ground.

Over 60,000 incidents reported each year.

It could happen to you.

Other insurance considerations:

-

- In Thailand, car insurance is legally required.

-

- Third-party insurance, known as Por Ror Bor is mandatory. And can be purchased through 7/11 and government offices (details below).

-

- There are 5 levels of car insurance available; 1, 2+, 2, 3+, and 3

-

- Consider add-ons like collision, comprehensive, personal accident, etc.

-

- Drop extra coverage you may not need.

-

- Insurers view foreign drivers as higher risk, be prepared to pay a higher premium.

-

- Inspect the policy language carefully.

-

- English translations may not capture nuances of Thai terms and conditions. Ask questions (this will also tests their service levels).

-

- Consider an insurance broker who specializes in policies for expats.

-

- If you don’t use an English speaking agent look for a policy with an English-speaking claims service. This can be invaluable if you’re in an accident.

-

- Review policy exclusions carefully – some policies may not cover certain risks like flooding, civil unrest, drunk driving, etc.

Finding the right car insurance that fits your budget and gives adequate coverage can take some savvy navigation. Do your homework before purchasing so you can drive legally and avoid any surprises down the road.

5 levels of car insurance

Confusingly there are three types of car insurance levels, but due to sub-levels there are typically five levels to choose from. Your chosen provider may not be able to offer all of these, enquire directly with your agent or insurance provider to explore what your available options are.

Type 1

Best cover – highest cost.

This insurance provides comprehensive coverage for all accidents, encompassing incidents that do not involve a third party.

For instance, if you swerve to avoid a dog and damage your car or accidentally collide with a post while parking, these occurrences will be covered. Depending on the policy, you may or may not be required to pay an excess fee of 1,000 Baht or more.

Typically applicable to cars less than seven years old, it is still obtainable for older cars in good condition without a significant accident history.

Type 2+

Similar to Type 1 insurance.

Type 2+ covers a wide range of accidents but excludes non-third party incidents. Unlike Type 1, which generally directs repairs to official garages, Type 2+ insurance often utilizes independent garages.

Type 2

Type 2 insurance is akin to Type 2+, but it lacks collision coverage.

Given this limitation, Type 2+ is commonly preferred, with only a few insurance companies still offering Type 2 coverage.

Type 3+

Type 3+ insurance provides protection against road accidents, includes collision coverage, and covers third-party property damage.

However, it does not extend coverage to theft, fire, flood, and terrorism.

Type 3

Basic option. Mandatory.

A popular choice for low-value cars. Type 3 insurance is a basic option that covers only medical expenses and third-party liability. Also known as Por Ror Bor.

Policy Coverage

Let’s have a look at some of the specific aspects of a policy and which type of insurance covers each.

Collision

Type 1, 2+, and 3+ insurance usually offer collision coverage.

This covers the cost of repairing your car as long as the damage is caused by a collision with another car.

The key difference between policies is usually where the car is fixed. A more expensive plan will allow you to take a car to the official dealer, whereas a cheaper plan will mean going to an independent garage.

When a car is written off (deemed irreparable), you will usually be offered 70-100% of the insurance payout limit, depending on the finer details of your policy.

Medical Expenses

All the aforementioned insurance types cover medical expenses incurred by a road accident. The coverage is usually similar across all types, and usually lower if you cause the accident.

The insurance company will require a medical receipt, unless you attend a partner hospital, in which case they will liaise directly with the hospital.

You also have the option to use your car insurance, health insurance, or family insurance policy to cover your medical expenses after a car accident.

Theft

Types 1, 2+ and 2 all cover theft, but remember that personal responsibility is a factor when a claim is being processed. For example: if you forget to lock your car and get burgled, you may receive a lower payout.

Fire/Flood

Flood damage related to accidental, as in a flash flood that swamps your car. Don’t expect to be compensated if you drive through floodwaters. You’ll see a lot of people make this mistake during rainy season. Similarly, you can’t torch your car and claim it was subject to a fire.

Like theft, Types 1, 2 and 2+ cover fire and flood damage.

3rd Party Property Damage

3rd Party Property Damage covers the opposing party in the accident. Type 3 insurance, for example, covers the third party but not you. So you pay for your own damage but not the other person’s damage.

3rd Party Personal Injury

All the insurance types, including Compulsory Third-Party Liability Insurance, have 3rd Party Personal Injury coverage. So you can claim compensation if a car hits you when walking down the street.

You may already have this coverage on other policies such as your medical insurance policy.

What is Por Ror Bor, and why do I need it?

Compulsory Third-Party Liability Insurance, commonly known as Por Ror Bor, is a fundamental insurance requirement mandated annually under the Road Protection Act for all vehicles in Thailand.

Necessary?

Yes, Por Ror Bor is essential as it is a legal requirement. Furthermore, the payment of your annual car tax is contingent upon having an active Por Ror Bor coverage.

Coverage

As the minimum stipulation, Por Ror Bor provides coverage solely for medical expenses resulting from a car accident per individual.

Basic Coverage:

-

- Injuries: Up to 30,000 baht

- Death and Dismemberment: Up to 35,000 baht

Non-At-Fault Extension:

-

- Injuries: Enhanced coverage of 80,000 baht

- Death and Dismemberment: From 250,000 to 500,000 baht

- Daily Allowance for Hospitalization: 200 baht per day, max. limit of 20 days

Cost

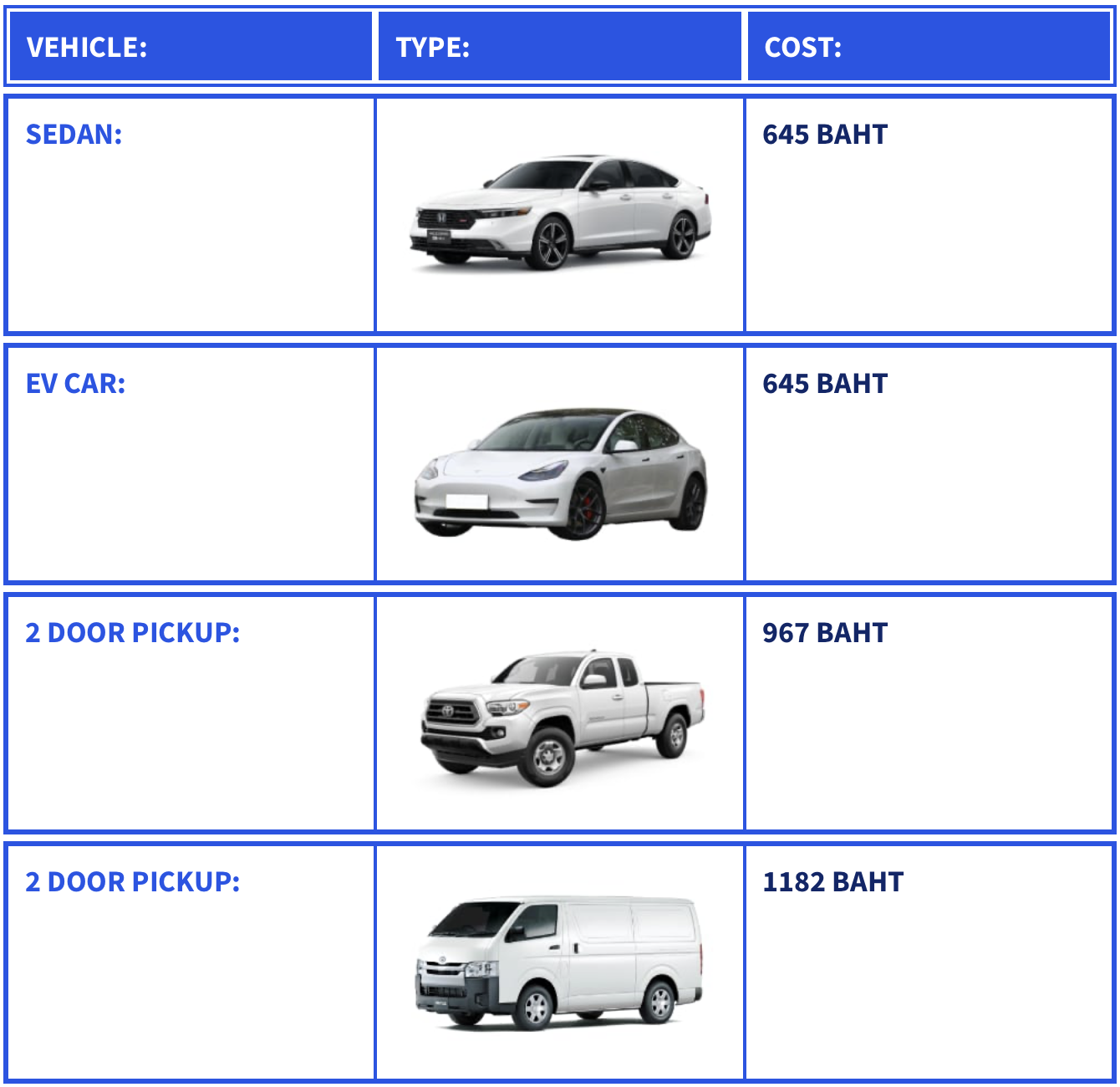

Annual fees (correct at the time of writing):

Where to buy?

Can be purchased at selected Government offices:

Chiang Mai Provincial Land Transport office 2:

https://maps.app.goo.gl/M4DRX3eTJatzTqpV6

18.745365381945483, 98.96190836089949

Can also be purchased at most 7/11 shops.

What documents do I need?

-

- A copy of your vehicle registration book

-

- A copy of a valid National ID or Passport

-

- An identity document (e.g. a copy of driver’s license)

Comparing Thailand’s Top 5 Car Insurers for Expats

When choosing car insurance in Thailand as an expat, you’ll want to consider these top providers:

AIA Insurance –

This major insurer offers comprehensive coverage and impressive service. Though premiums are on the higher side, you get robust protection and benefits like 24/7 emergency roadside assistance.

LMG Insurance –

Popular with expats, LMG boasts affordable premiums and packages tailored for foreigners. They have in-house adjusters and a reputation for quick, hassle-free claims resolution.

Safety Insurance –

Safety is one of Thailand’s largest insurers with competitive pricing. While their English support is limited, they offer solid coverage options from third party liability to premium protection.

Dhipaya Insurance –

A Thai company catering to expats, Dhipaya is known for personalized service and packages that account for the unique risks foreigners face. They offer value-added services like free policy delivery.

Bangkok Insurance –

This leading national insurer provides comprehensive plans with plenty of add-ons. Though more expensive, their premier coverage and renowned claims service make them worth considering.

When reviewing these and other insurers, compare premiums, coverage details, exclusions, and benefits to find the optimal balance of price and protection. Consulting an insurance broker can simplify the search for the right policy. With the proper due diligence, you can find great coverage without breaking the bank.

Tips for Finding the Best Rates on Expat Car Insurance

Finding affordable car insurance as an expat in Thailand can take some savvy shopping around. Here are a few tips to help you get the best rate:

-

- Compare quotes from expat insurance specialist agents, local Thai insurance providers, and international providers.

-

- Local Thai companies may offer lower premiums, while international insurers can provide coverage if you travel outside Thailand.

-

- An insurance service that’s specifically aimed at Expat’s in Thailand may provide the best collection of service, quality and cost.

-

- Drop extra coverage you may not need. Comprehensive and collision coverage is mandatory in Thailand, but you likely can decline add-ons like personal accident insurance.

-

- Raise your deductible. Opting for a higher deductible usually results in a lower premium. Make sure you can afford the out-of-pocket expense in case of an accident.

-

- Maintain a good driving record. Traffic violations and claims will drive your premiums up. Drive safely and avoid accidents to keep rates as low as possible.

-

- Name the driver. This is likely to reduce your premium. Many select ‘any driver’ without realising they are paying an additional premium for that service.

Shopping around and customizing your policy is the best way to get affordable rates. And be sure to work with an insurer or broker who understands the unique needs of expats. With the right coverage at the right price, you can drive with peace of mind.

Should you agree to a voluntary excess or deductible?

When choosing car insurance in Thailand as an expat, you’ll likely be offered the option to select a voluntary excess, also called a deductible. This allows you to choose a higher excess amount in exchange for lower premiums.

-

- A voluntary excess of 10,000 to 50,000 THB can reduce your premiums by 10-30%. But if you make a claim, you’ll pay more out of pocket for repairs before coverage kicks in.

-

- Consider your budget and risk tolerance. If you can afford higher repair bills in the event of an accident, agreeing to a voluntary excess could save you money on premiums.

-

- Select an excess amount you could comfortably pay in cash if needed. Too high of an excess defeats the purpose of insurance if you can’t cover the costs.

-

- Certain benefits like windshield repair may carry a separate excess amount. Read the fine print so you understand any applicable excesses.

-

- You can often change your voluntary excess annually upon renewal if your needs or finances change.

-

- For newer drivers or those prone to accidents, avoiding a voluntary excess may be safest to limit potential out-of-pocket costs.

Agreeing to a voluntary excess in Thailand is an effective way to reduce premiums, but weigh the pros and cons carefully based on your individual situation. Knowing your coverage details is key to making the right choice.

Car Insurance Claim Procedure in Thailand

Many insurance providers facilitate the convenient filing of claims through online channels.

If you possess the claim form provided by your insurance, you can promptly submit it to the insurance company. Once your claim is submitted, the repair garage will handle all necessary procedures and schedule a date for you to retrieve your vehicle.

It is advisable to obtain a claim number for tracking purposes upon submission. Below is a list of documents typically required for initiating a claim:

-

- Copy of the first page of your bank account book

-

- Copy of a valid driver’s license

-

- Copy of the insurance policy

-

- Copy of the first page of your passport

- Copy of the vehicle’s registration

Expat Car Insurance FAQs:

Being an expat living in Thailand, you likely have lots of questions when it comes to insuring your vehicle. Here are some common FAQs to help you navigate the process:

At minimum, you’ll need compulsory third party liability insurance to cover injury to others or damage to their property if you’re at fault in an accident. Consider adding on first party coverage for damage to your own car.

This is possible, but may end up being more expensive. Local Thai insurers often offer better rates.

Expect to pay anywhere from 2,000 to 15,000 baht per year, depending on the level of coverage, your car’s value, and other factors like your driving history. Shop around for the best rate.

Yes! Many insurers offer discounts for multi-car policies, low mileage, anti-theft devices, and more. Ask providers what discounts you may qualify for.

You’ll need your driver’s license, passport/visa, car registration, proof of address, and potentially a letter from your employer. Insurers may require slightly different docs.

Your driving record, claims history, car make/model/age, level of coverage, and personal details like age and gender can impact rates.

Report the accident to police and your insurer ASAP. The insurer will investigate and determine fault before approving repairs or payout. Keep thorough documentation.

Some insurers may require a translation of your foreign license.

Check in advance if you need an International Driving Permit.

Conclusion

So there you have it – the inside scoop on buying expat car insurance in Thailand.

While it may seem daunting at first, doing your research, understanding the requirements, and finding an insurer that meets your needs can make getting properly covered much smoother. With a reliable policy that fits your situation, you can cruise the streets of Bangkok or the winding roads of Chiang Mai with confidence and peace of mind.

Whether it’s your first month in the Land of Smiles or you’re a Thailand expat veteran, don’t wait to get insured. Protect yourself, your passengers, and your investment, and enjoy the ride!